If you are juggling multiple high-interest debts with a low credit score, it can feel like there is no way out. Debt consolidation for bad credit is possible, but it is not a magic fix and it is not right for everyone.

This guide walks you through when a debt consolidation loan makes sense with poor credit, how to boost your credit score in the next 60 days, where to find legitimate lenders, how to avoid scams, and what to do if you are denied. You will also get a practical plan to rebuild your finances so you do not end up back in the same place.

Is a Debt Consolidation Loan a Smart Move with Bad Credit?

The big question is not just “Can I get approved?” It is “Will this actually help me?” With bad or poor credit, you can still qualify for a personal loan, but you should expect a higher Annual Percentage Rate (APR) and possibly an origination fee deducted from the loan amount.

A debt consolidation loan is a tool. You take out one new loan and use it to pay off several existing debts like credit cards, payday loans, or medical bills. You then make a single monthly payment on the new loan. The goal is to simplify your cash flow and ideally lower your average interest rate and total cost over time.

However, consolidation does not erase debt or fix spending habits. If you keep using credit cards the same way, you can end up with more debt than before. That is why this guide focuses on both the loan and your long-term financial plan.

The Litmus Test: Who Is This Truly For?

Debt consolidation can make sense if most of the following are true for you:

- You are juggling 3 or more high-interest debts, such as credit cards, payday loans, or store cards.

- Your current average APR is over 20%, so a new loan even at a higher “bad credit” rate could still be lower.

- You have a steady income and can realistically afford a new fixed loan payment each month.

- You are committed to changing financial habits, including budgeting and avoiding new unnecessary debt.

If you cannot check most of these boxes, a consolidation loan might not be the best move. Alternatives like a debt management plan (DMP) with a non-profit credit counseling agency or a DIY payoff method may fit better.

Your 60-Day Prep Plan: Boost Your Score Before You Apply

Most people rush to apply for a loan and then hope for the best. A smarter move is to spend 30 to 60 days improving your credit score first. Even a small jump in your FICO Score, for example from 570 to 600, can mean a better rate or fewer fees.

Credit scoring models evaluate several factors, including payment history and credit utilization. The Consumer Financial Protection Bureau explains the key factors that are typically taken into account by credit scoring models, which is helpful context as you work this plan.

Week 1-2: Audit and Dispute

Your first step is to pull all your major credit reports and check them for errors that could be holding down your score.

- Get your free reports. You are entitled to free reports from Equifax, Experian, and TransUnion. You can pull your free credit reports from AnnualCreditReport.com, which is the only site authorized by federal law.

- Review each report carefully. Look for:

- Late payments that you believe are inaccurate

- Incorrect balances or credit limits

- Accounts you do not recognize

- Old negative items that should have fallen off

- Dispute errors in writing. Each bureau has an online and mail-in dispute process. Provide documents that back up your claim, such as bank statements or letters from creditors.

- Track responses. Bureaus typically investigate within about 30 days. If errors are removed, your FICO Score may increase, sometimes meaningfully.

Correcting even one major error, like an incorrect late payment, can make the difference between approval and denial or between a very high rate and a more reasonable one.

Week 3-4: Strategic Debt Reduction

Next, focus on “quick wins” that can influence your score fast, especially your credit utilization ratio.

Credit utilization is the percentage of your available revolving credit that you are using, mainly on credit cards. For example, if your total credit limits equal 5,000 dollars and your balances total 4,000 dollars, your utilization is 80 percent, which is very high. Many experts suggest aiming for under 30 percent overall and on individual cards.

- List all your credit cards. Include balance and credit limit for each card.

- Find the card with the highest utilization. That is usually the card where the balance is closest to the limit.

- Target that card aggressively. In weeks 3 and 4, throw as much as you can at this balance, even if it is 200 to 500 dollars. Lowering utilization on just one card can improve your score quickly, sometimes within a billing cycle.

- Avoid new charges. Try to pause using this card for new spending, so your progress is not erased.

This step not only helps your credit profile but also slightly reduces the total amount you will need to consolidate later.

Week 5-8: Build Positive History

The final stretch is about proving stability and reliability. Lenders want to see that you can handle debt responsibly even before they approve a new loan.

- Make every payment on time. Payment history is the biggest factor in most scoring models. For the next 30 to 60 days, set up automatic payments or reminders so nothing is late.

- Pay at least the minimums. If you can pay more, great, but never miss minimum payments during this period.

- Do not open new credit lines. New accounts and hard inquiries can hurt your score in the short term. Avoid new credit cards, store cards, or unnecessary personal loans right now.

- Keep old accounts in good standing. Do not close long-standing accounts unless there is a compelling reason, because they help your average account age.

These weeks are also a good time to organize your financial documents, such as pay stubs and bank statements, which you will need when you start applying for consolidation loans.

Downloadable Pre-Application Checklist (EEAT)

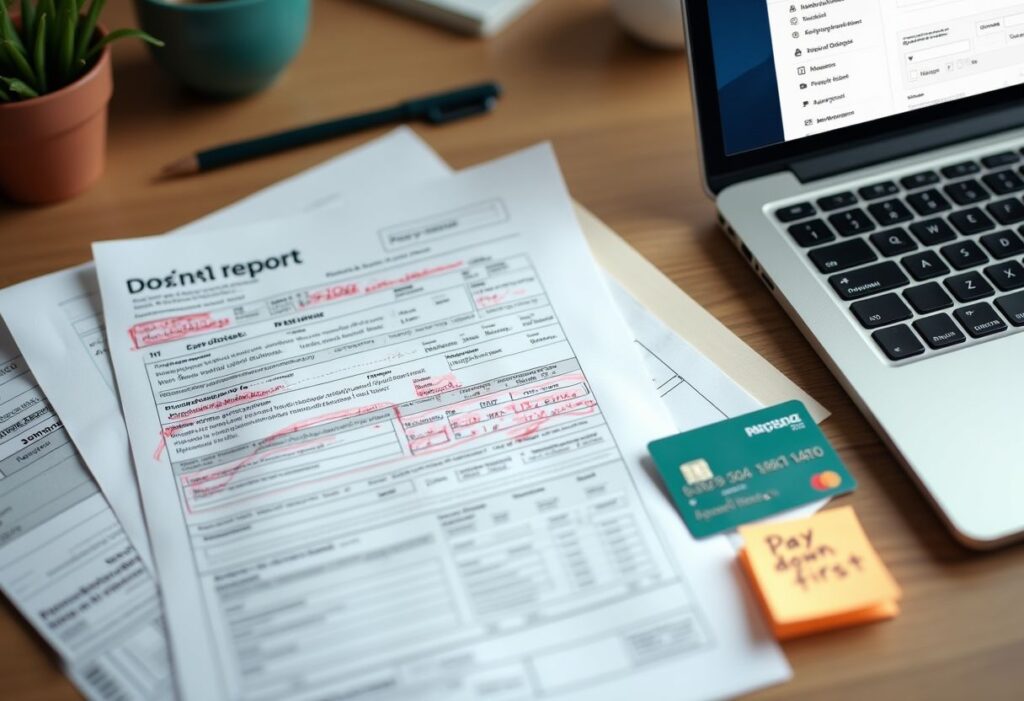

Before you apply, use a checklist that covers:

- Updated FICO Score and total debt amount

- Average APR across all current debts

- Errors you have disputed and their status

- Balances you have strategically paid down

- Monthly income and core expenses, to estimate an affordable payment

- List of potential lenders to research

Having these items ready puts you in control. You will be able to compare offers confidently and avoid high-pressure sales tactics because you already know what you are looking for.

Where to Find Legitimate Lenders (and How to Compare Offers)

Once your 60-day prep is underway or complete, it is time to look for lenders who work with bad credit applicants. Your options will typically include online lenders, credit unions, and sometimes banks or specialized finance companies.

Online Lenders: The Pros and Cons

Many online lenders specialize in personal loans for people with fair or bad credit. They often provide quick decisions and funding, plus pre-qualification tools that use a soft credit pull so your score is not affected.

Pros of online lenders:

- More flexible approval criteria than some traditional banks

- Fast applications and funding, sometimes within 1 to 3 days

- Easy online tools to compare APRs, fees, and terms

- Pre-qualification using a soft inquiry

Cons of online lenders:

- APR can still be very high with bad credit, sometimes over 30 percent

- Origination fees may be higher than local credit unions

- Some lesser-known companies may use aggressive or confusing marketing

Examples of reputable online lenders can include large, established names that you will often see in personal loan marketplaces and comparison tools. Always read reviews, check Better Business Bureau ratings, and review terms carefully.

Credit Unions: Your Local Advantage

Credit unions are member-owned financial institutions that often prioritize member service over profit. They may be more willing to work with you if you have a lower FICO Score but a stable income and a reasonable debt-to-income ratio.

To apply for a personal loan at a credit union, you usually need to become a member. Membership might be based on your employer, location, or an association. The process is often simple and can sometimes be completed online.

Benefits of credit unions for bad credit borrowers include:

- Potentially lower APRs than some online lenders

- More personal underwriting, which can consider your overall situation

- In-person guidance on budgeting and debt options

Comparing Loan Offers: A Deeper Look Than Just APR

APR is important, but it is not the only factor. You also need to look at loan type, fees, and flexibility so you do not pay more than necessary.

Here is a simplified comparison of three common options for people with bad credit:

| Loan Type | Secured or Unsecured | Typical Use for Bad Credit | Pros | Cons |

|---|---|---|---|---|

| Personal Loan (Debt Consolidation Loan) | Unsecured loan | Consolidate credit cards, payday loans, medical bills | Does not require collateral, fixed payment and term, can improve cash flow | Higher APR with bad credit, may have origination fee, requires sufficient income |

| Secured Loan | Secured by collateral like a vehicle or savings | Consolidate debt with slightly lower APR if you have an asset | Lower rates possible, easier approval | Risk of losing collateral if you default, may include added fees and insurance add-ons |

| Home Equity Line of Credit (HELOC) | Secured by home equity | For homeowners with equity who want to consolidate or refinance debt | Often lower APR than personal loans, flexible access to funds | Puts your home at risk, variable rates, closing costs and longer payoff horizon |

Origination fees. Many lenders charge an origination fee, often 1 to 10 percent of the loan amount, to process your loan. It is usually deducted from the loan proceeds. For example, if you borrow 15,000 dollars with a 5 percent origination fee, you receive 14,250 dollars but still owe 15,000 dollars. Always compare the total cost, not just the APR.

Prepayment penalties. Some loans charge a fee if you pay off the loan early. Since your goal is to become debt-free as soon as you can, look for loans with no prepayment penalty.

Pre-qualification and soft pulls. Many lenders allow you to check rates with a soft credit inquiry, which does not impact your score. Use this to compare offers before you commit to full applications that trigger hard inquiries.

Case Study: How a 580 FICO Score Became a Single, Manageable Payment

To see how this might work in real life, consider a realistic example. Names and details are anonymized, but the numbers reflect common situations.

Sarah’s Situation

Meet Sarah, who lives in the US and has been struggling with high-interest debt for years.

- FICO Score: 580

- Debts: 15,000 dollars total

- 4 credit cards with an average APR of 24 percent

- 1 personal loan with an 18 percent APR

- Monthly payments: Around 650 dollars total

- Pain point: Despite paying 650 dollars every month, her balances hardly move because so much goes to interest.

Sarah feels overwhelmed, and the mix of due dates makes it easy to miss or be late on a payment, which further hurts her credit score.

Sarah’s Action Plan

Instead of immediately applying for any loan she could find, Sarah followed a version of the 60-day prep plan.

- She ordered her free credit reports and found one credit card reported a late payment that was actually paid on time. She disputed it and it was corrected.

- She focused on the card with the highest utilization and paid 500 dollars toward that balance during weeks 3 and 4.

- She made every payment on time for two months and avoided opening any new credit.

These steps raised her FICO Score from 580 to 605. With that modest improvement, she:

- Pre-qualified with three online lenders using soft credit checks

- Applied with one local credit union she joined through her employer

Having multiple offers allowed Sarah to compare APRs, fees, and terms rather than accepting the first option.

The Outcome

Sarah chose a 15,000 dollar unsecured personal loan from a reputable online lender.

- Loan amount: 15,000 dollars

- APR: 17 percent

- Origination fee: 5 percent (750 dollars, deducted from the loan proceeds)

- Term: 48 months

The new loan paid off all 4 credit cards and the older personal loan. Her new single monthly payment is about 450 dollars, which saves her roughly 200 dollars each month in cash flow.

Based on the amortization schedule, she has a clear timeline to be debt-free in 48 months, as long as she does not run up new balances on her old cards. She also uses part of her monthly savings to start building an emergency fund and to occasionally pay extra toward the new loan.

Sarah did not fix her finances overnight. But by using a consolidation loan as a strategic tool, combined with better habits, she turned a chaotic, expensive situation into a single manageable plan.

Red Flags: How to Spot and Avoid Predatory Consolidation Scams

People with bad credit are often targeted by predatory lenders and outright scams. Recognizing warning signs can protect you from even worse financial stress.

Warning Sign #1: Guaranteed Approval

Legitimate lenders must assess risk, including your credit score, income, and debt-to-income ratio. No real lender can guarantee approval for a personal loan before reviewing your information.

Be suspicious of marketing that promises:

- “Guaranteed approval regardless of credit”

- “No income verification, no problem”

- “Everyone is approved instantly”

These claims often hide extremely high APRs, abusive fees, or terms that trap you in a cycle of debt.

Warning Sign #2: Upfront Fees or Pressure to Act Now

One of the biggest red flags is a lender asking you to pay a fee before you receive any loan funds. This is different from an origination fee, which is typically taken out of your loan proceeds after approval.

The Federal Trade Commission explains in its FTC guidelines on advance-fee loan scams that it is illegal for lenders to collect upfront fees for certain types of loans before they are granted. Scammers will often ask you to pay “processing,” “insurance,” or “guarantee” fees via gift cards, wire transfers, or cryptocurrencies.

Also be cautious of high-pressure tactics like:

- “This offer expires tonight.”

- “You must decide now to lock in low rates.”

- “Send the fee today or you lose your approval.”

Legitimate lenders give you time to review written disclosures and make an informed decision.

Warning Sign #3: Vague Terms and Hidden Costs

Another red flag is a lender that avoids giving you clear information in writing. You should know the APR, loan term, all fees, and whether there is a prepayment penalty before you sign anything.

Watch out for:

- Loan agreements that are extremely short on details

- Verbal promises that do not appear in the contract

- Hidden add-ons like expensive credit insurance that you did not request

Always read the full loan agreement. If you do not understand something, ask for clarification or have a trusted third party review it.

What to Do if You Suspect a Scam

If something feels off, trust your instincts. You can:

- Stop communicating with the suspected scammer and do not send money.

- Report the incident to the Consumer Financial Protection Bureau and the Federal Trade Commission.

- File a complaint with your state attorney general’s office.

- Alert your bank or card issuer if you already shared sensitive information.

Reporting scams helps protect you and others from similar tactics in the future.

The Real Work Begins: Your Post-Consolidation Financial Plan

Getting a debt consolidation loan is not the end of the story. It is the beginning of a new phase where your decisions either lock in your progress or send you back into deeper debt.

Step 1: Create a ‘Debt-Free’ Budget

Your first priority after consolidation is to build a realistic budget that prioritizes the new loan and essential expenses. A simple framework is the 50/30/20 rule, which you can adjust to your situation.

- 50 percent of take-home pay to needs (housing, utilities, groceries, minimum debt payment)

- 30 percent to wants (dining out, entertainment, non-essential shopping)

- 20 percent to debt payoff and savings

If you are deeply in debt, you may need to temporarily cut “wants” more aggressively and direct extra money to your consolidation loan and emergency savings. Technology can make this far easier. Consider using one of the best free budgeting apps to automatically track spending, categorize transactions, and keep you accountable.

Also address the psychological side. Identify your spending triggers, such as stress, boredom, or social pressure. Create small rules for yourself, like a 24-hour waiting period before buying non-essentials, to break impulsive habits that caused trouble in the past.

Step 2: What to Do with Your Old Credit Cards

After consolidation, your credit card balances should be paid off or nearly so. Now you must decide whether to close those accounts or keep them open.

Keeping cards open with zero balance:

- Helps maintain your length of credit history

- Improves your overall credit utilization ratio, which can support your credit score

- Can provide backup access in true emergencies, if used carefully

Risks of keeping them open:

- Temptation to run balances back up

- Old habits of overspending may return if there is no plan

Closing some cards:

- Can remove temptation, especially for your worst “problem card”

- May reduce available credit, which can negatively affect utilization and your score

For many people, a middle path works best. Keep a few cards open with zero balances for credit-building, but physically store them in a safe place instead of your wallet. You might even lower the limits on certain cards to reduce the risk of overspending.

Step 3: Build a ‘Debt-Proof’ Emergency Fund

Without an emergency cushion, one car repair or medical bill can send you running back to credit cards or payday loans. You do not need a huge fund to start, though. Aim first for 500 dollars in a basic emergency fund to handle small but urgent expenses.

Your emergency savings should be separate from daily spending money so you are not tempted to use it for routine purchases. It helps to understand the distinct roles of checking vs. savings accounts, and to keep your emergency fund parked in a dedicated savings account, not your checking account.

Once you have that first 500 dollars, keep building toward 1,000 dollars and then one month of core expenses. To make your savings work harder while keeping it safe, consider placing it in an account that pays higher interest. You can compare options by reviewing the top high-interest savings accounts available, focusing on accounts that are FDIC-insured and allow easy access when emergencies strike.

Even small automatic transfers, such as 25 to 50 dollars per paycheck, add up over time. This fund is your buffer against falling back into high-interest debt.

What if You’re Denied? Effective Alternatives to a Loan

Not everyone will qualify for a debt consolidation loan, even after following the prep plan. A denial is discouraging, but it is not the end of your options.

Non-Profit Credit Counseling and Debt Management Plans (DMPs)

Non-profit credit counseling agencies can review your entire financial picture and suggest solutions that do not require a new loan.

One powerful option is a debt management plan (DMP). With a DMP:

- The agency works directly with your creditors to negotiate lower interest rates and waive some fees.

- You make a single monthly payment to the agency, and they distribute funds to your creditors.

- Many unsecured debts like credit cards can be included, though student loans and secured debts may not be.

To avoid scams, it is crucial to work with a reputable non-profit. You can find a reputable agency through the National Foundation for Credit Counseling (NFCC), which provides a directory of vetted members.

The Debt Snowball or Avalanche Method

If a new loan or DMP is not a fit, you can tackle your debts yourself with structured payoff strategies. Two of the most popular are the debt snowball and debt avalanche methods.

Debt Snowball Method:

- List your debts from smallest balance to largest, ignoring APR.

- Pay minimums on all debts except the smallest.

- Throw every extra dollar at the smallest debt until it is paid off.

- Roll that payment into the next smallest debt, building momentum.

This method provides quick psychological wins, which can help you stay motivated.

Debt Avalanche Method:

- List your debts from highest APR to lowest.

- Pay minimums on all debts except the one with the highest APR.

- Direct all extra money to the highest-interest debt first.

- Once it is paid off, move to the next highest APR.

The avalanche method usually saves more money in interest over time, but it might take longer to see your first debt disappear. Choose the method that you are most likely to stick with consistently.

Finding a Cosigner: A Serious Decision

Another way to qualify for a debt consolidation loan when you have bad credit is to use a cosigner with stronger credit and income.

However, this is a serious commitment for both of you:

- The cosigner is equally responsible for the debt. If you miss payments or default, their credit score and finances are affected.

- The loan will likely appear on their credit report, increasing their debt-to-income ratio.

- Missed payments can damage your relationship as well as your credit.

Before asking someone to cosign, create a clear written plan for how you will manage payments and what steps you will take if your income changes. Consider whether other alternatives could work before involving a loved one in your debt.

Frequently Asked Questions About Bad Credit Debt Consolidation

Will a debt consolidation loan hurt my credit score?

Applying for a consolidation loan usually triggers a hard inquiry, which can cause a small, temporary dip in your credit score. Opening a new account may also lower your average account age. Over time, though, a well-managed loan can help your score if you make on-time payments and reduce your overall credit utilization by paying off revolving accounts.

What’s the lowest credit score to get a consolidation loan?

There is no universal minimum FICO Score, because each lender sets its own criteria. Some lenders may consider applicants with scores around 580 to 600, especially if your income is stable and your debt-to-income ratio is reasonable. Others might require higher scores. That is why pre-qualification tools and shopping around with multiple lenders are so important.

Can I get a debt consolidation loan with no credit check?

Loans that advertise “no credit check” are almost always very expensive and often predatory. They may come with extremely high APRs and fees that make your situation worse, not better. Legitimate lenders will at least perform a soft or hard credit check to evaluate your risk, even if they work with bad credit borrowers.

How do I apply for a debt consolidation loan?

Applying typically involves several steps:

- Calculate your total debt and current average APR so you know what you are trying to beat.

- Check your credit report and score, and use the 60-day prep plan to improve your profile if possible.

- Gather documents like recent pay stubs, ID, proof of address, and details about your debts.

- Use pre-qualification with online lenders or credit unions to see estimated terms using soft credit pulls.

- Compare APRs, origination fees, terms, and any prepayment penalties.

- Submit full applications to your top choice or two, then carefully review the final offer before accepting.

Your First Step Toward Financial Freedom

If you are living with high-interest debt and a low credit score, it is easy to feel trapped. A debt consolidation loan will not magically solve everything, but with the right preparation and follow-through, it can turn a chaotic pile of bills into one clear, manageable plan.

Remember the core idea: consolidation is a tool, not the solution by itself. The real progress happens when you combine a well-chosen loan with better habits, a realistic budget, and a growing emergency fund so you do not need to rely on high-interest credit again.

Your next step does not need to be huge. Start by pulling your credit reports, following the 60-day prep plan, and organizing your debts and income. Use the pre-application checklist to get ready, then explore legitimate lenders and alternatives with clear eyes.

Taking that first informed, manageable step today is how you move from feeling overwhelmed by debt to being in control of your financial future.