If you owe back taxes and the IRS is sending scary letters, threatening wage garnishment, or talking about liens and levies, it can feel like your life is on hold. The good news is that tax relief services and official IRS programs give you multiple paths to resolve IRS debt, often without needing to hire anyone at all.

This guide shows you exactly how. You will learn how IRS collections really work, the main IRS tax relief programs you can use yourself, how to decide if you need a tax professional, how tax relief firms charge and operate, how to avoid scams, and what happens with state tax debt. By the end, you will have a clear plan for taking your next step toward tax debt relief.

Overwhelmed by Tax Debt? You Have More Options Than You Think

Opening an IRS (Internal Revenue Service) notice and seeing words like “Intent to Levy” or “Wage Garnishment” can spike your anxiety. Many people freeze, ignore the letters, and hope the problem will somehow go away. That only makes things worse, but it is a very human reaction.

You are not stuck and you are not alone. The IRS has structured programs that help taxpayers in financial distress repay over time, reduce penalties, or in some cases settle for less than the full amount. There are also legitimate professionals who can step in and deal with the IRS for you when things are complex or overwhelming.

Here is how this guide is structured so you can move from fear to a concrete plan:

- First, you will decode how IRS collections work so the process feels less mysterious and threatening.

- Next, you will learn the main official IRS tax relief options you can pursue directly, including Installment Agreements, Offer in Compromise, Currently Not Collectible, and Penalty Abatement.

- Then, you will walk through a clear framework to decide whether to go the DIY route or hire a pro.

- After that, you will see how professional tax relief services really work, including credentials, fees, and the typical process.

- Finally, you will learn how to spot scams, handle state tax debt, and review real case studies and FAQs so you can take your next step confidently.

Decoding IRS Collections: What Happens When You Owe Back Taxes

Understanding what the IRS can and cannot do is the first step to lowering your stress. IRS collection is a process, not a lightning strike. There are notices, opportunities to respond, and rights you can exercise along the way.

When you owe federal tax debt and do not pay on time, the IRS first sends a bill. If you still do not pay or make arrangements, the IRS can assess penalties and interest, file a tax lien, and eventually take collection actions such as a tax levy, wage garnishment, or bank levy. Each step takes time and usually comes with written notice.

Common IRS Notices and What They Mean (CP504, CP90)

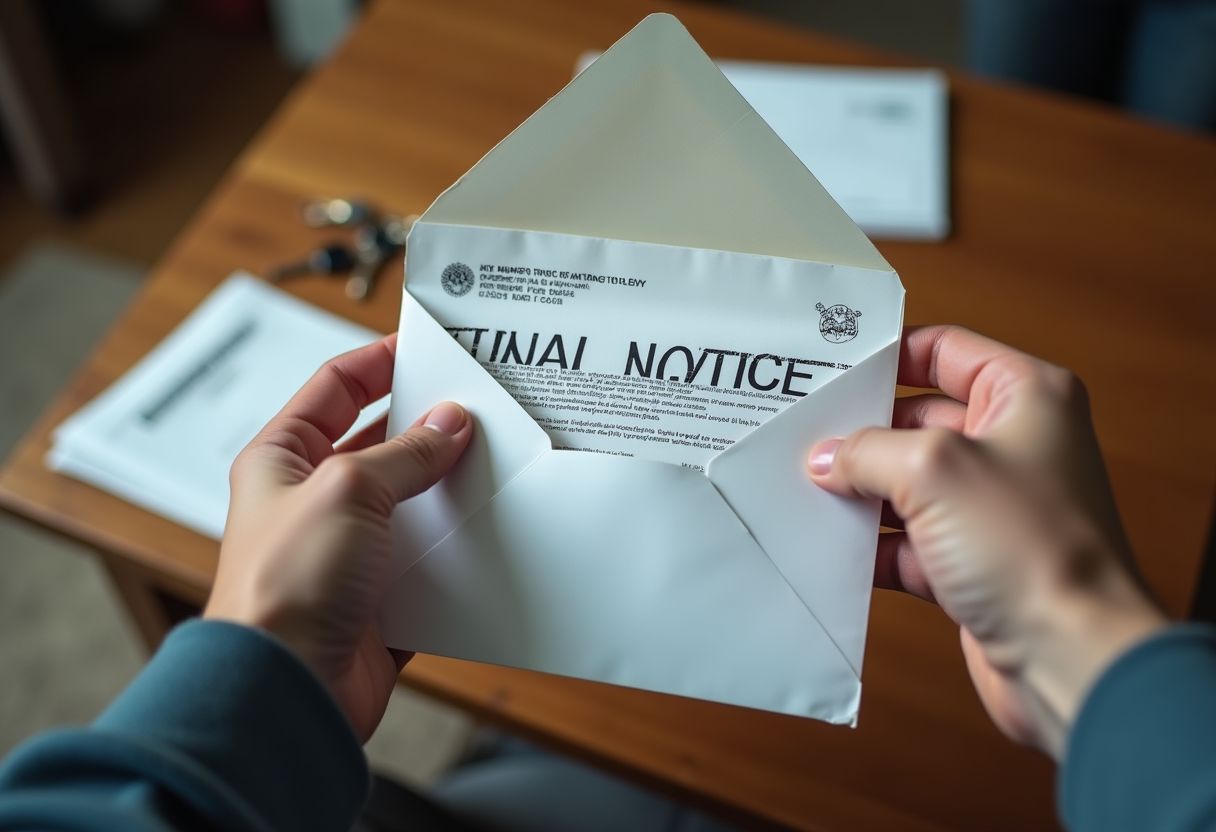

IRS notices are coded with letters and numbers, like CP504 or CP90. These codes tell you how urgent the situation is and what the IRS plans to do next.

CP504 is a notice of intent to levy a specific type of property, usually a state income tax refund. It also tells you that the IRS may file a Notice of Federal Tax Lien. A CP504 is serious, but it is still early enough to set up a payment plan or address errors before harsher collection actions.

CP90 (or LT11) is a “Final Notice of Intent to Levy and Notice of Your Right to a Hearing.” This means the IRS intends to levy your wages, bank account, or other property if you do not act, and it triggers important appeal rights.

For each notice, your immediate first steps should be:

- Open and read the notice completely, including the deadlines.

- Verify that the tax year and amount look plausible, especially if you suspect identity theft or an IRS error.

- Contact the IRS by phone or in writing before the deadline on the notice to either dispute the amount or discuss payment options.

- For CP90, consider requesting a Collection Due Process (CDP) hearing if you need to challenge the levy or propose an alternative like an Installment Agreement or Offer in Compromise.

Responding early makes it easier to negotiate and can prevent liens, levies, and garnishments from ever happening.

Tax Lien vs. Tax Levy: What’s the Real Difference?

People often confuse a tax lien with a tax levy, but they are very different. A simple analogy can help.

Think of a tax lien as the IRS placing a “secured interest” marker on your property, like a stake in the ground. It does not take your property, but it puts the world on notice that the IRS has a legal claim against your assets because of unpaid tax debt.

A tax levy, on the other hand, is the IRS actually taking property or money to satisfy your back taxes. A levy is an action, not just a claim. With a levy, the IRS can take money from your bank account, garnish wages, or in extreme cases seize physical assets.

- Impact of a Tax Lien: A filed Notice of Federal Tax Lien can make it harder to get credit, sell or refinance property, and can impact business relationships. The lien attaches to current and some future property.

- Impact of a Tax Levy: A levy directly removes money or property from your control. Bank levies usually grab whatever is in the account on the day the levy hits. Wage garnishments continue every pay period until the debt is resolved or the levy is released.

The good news is that tax liens and levies are usually preceded by multiple notices. If you act during that window, you may be able to prevent them entirely.

How IRS Wage Garnishments and Bank Levies Work

An IRS wage garnishment is called a “continuous levy.” The IRS sends a notice to your employer, who must hold back a portion of each paycheck and send it to the IRS. The amount the IRS leaves you is based on a table that considers your filing status and number of dependents, and it is often less than you need to live on comfortably.

A bank levy is different. The IRS sends a levy notice to your bank, which must freeze the funds in your accounts up to the amount of the levy. After a brief holding period, usually 21 days, the bank sends the money to the IRS unless the levy is released. The IRS can levy both checking and savings accounts, so understanding how bank accounts are treated during a levy is important if you are at risk.

Key points about wage garnishments and bank levies:

- They usually occur after several notices, including a Final Notice of Intent to Levy.

- You generally have the right to appeal or request a hearing before the first levy is issued.

- Once in place, levies can sometimes be released or modified if you enter into an Installment Agreement, prove hardship, or qualify for Currently Not Collectible status.

- These are late-stage collection actions, which means proactive contact and negotiation with the IRS can often prevent them from ever happening.

Official IRS Tax Relief Programs: The DIY Path to Resolution

The IRS offers several programs that let you resolve tax debt directly without hiring a third party. These are the same programs tax relief companies use, and many taxpayers successfully use them on their own.

If you can stay organized and communicate clearly, you can often set up an Installment Agreement, apply for an Offer in Compromise (OIC), request that your account be placed in Currently Not Collectible status, or ask for Penalty Abatement yourself. Understanding how each option works will empower you to choose the best fit for your situation.

The IRS Fresh Start Program: An Overview

The Fresh Start Program is not a single program, but a set of policy changes the IRS introduced to make it easier for taxpayers to get back into compliance. It expanded access to streamlined Installment Agreements, relaxed some rules for Offers in Compromise, and raised the thresholds for when the IRS files tax liens.

For example, under Fresh Start, more taxpayers can qualify for streamlined payment plans with less paperwork, and some people who would not have qualified for an OIC in the past now may have a chance if they can show genuine financial hardship. These changes are especially helpful for individuals and small businesses who are trying to resolve their back taxes without shutting down their lives or companies.

Option 1: IRS Installment Agreement (Payment Plan)

An Installment Agreement, often called a payment plan, lets you pay your tax debt over time in monthly installments. This option is best if you can afford to pay the full balance, plus penalties and interest, but need time.

You can usually set up a streamlined payment plan if:

- You owe $50,000 or less in combined tax, penalties, and interest.

- All required tax returns have been filed.

- You can pay off the balance within a defined period, often 72 months or less.

To apply online, you can use the IRS’s Online Payment Agreement (OPA) tool. If you prefer paper, you can file Form 9465, Installment Agreement Request.

Here is a simple step-by-step guide:

- Gather your most recent IRS notices and your income and expense information.

- Go to the OPA tool and log in or create an account.

- Enter how much you owe and propose a monthly payment that fits your budget.

- Submit your request and wait for the IRS decision, which often comes quickly for streamlined cases.

- If you cannot use the online tool, complete Form 9465 and mail it according to the instructions.

Streamlined vs. non-streamlined agreements:

- Streamlined agreements require less financial disclosure and are quicker to approve. They are available for many taxpayers who owe under certain thresholds.

- Non-streamlined agreements are for larger or more complex debts and often require detailed financial statements and additional negotiation with the IRS.

Option 2: Offer in Compromise (OIC)

An Offer in Compromise (OIC) is a formal agreement where the IRS accepts less than the full amount you owe to settle your tax debt. This program is designed for taxpayers who truly cannot pay the full balance and for whom collection would create serious economic hardship.

There are three main types of OIC:

- Doubt as to Collectibility: Used when you cannot pay the full tax debt before the collection statute expires, even if you sold assets or used all available income.

- Doubt as to Liability: Used when there is a legitimate dispute about whether you actually owe the tax or the amount is wrong.

- Effective Tax Administration: Used when you technically could pay, but doing so would cause exceptional hardship or be unfair, for example serious illness or disability.

The IRS evaluates OICs using a concept called Reasonable Collection Potential (RCP). RCP is based on your equity in assets plus a portion of your future disposable income, after allowing for certain basic living expenses. The offer amount must usually be at least equal to or greater than your RCP.

To estimate if you might qualify, you can use the official IRS resources on Offers in Compromise, including the IRS’s OIC Pre-Qualifier Tool. The OIC process requires detailed financial documentation, especially on Form 433-A (OIC) for individuals and some businesses. Because you must list income, expenses, assets, and debts, getting a clear picture of your finances first, such as by using one of the best free budgeting apps, can make this step much easier.

A typical OIC process looks like this:

- File all required tax returns and make any required estimated tax payments. The IRS will not consider an OIC if you are not in compliance.

- Complete Form 656 (the OIC application) and the appropriate financial disclosure forms such as Form 433-A (OIC).

- Calculate your offer based on the RCP formula and how you plan to pay (lump sum or periodic payments).

- Submit the application with the required fee and initial payment, unless you qualify for a low-income waiver.

- Respond to any IRS requests for additional information while your offer is being reviewed, which can take many months.

An OIC can be life changing for qualifying taxpayers, but it is not a quick fix and many offers are rejected. It is crucial to be honest and thorough, and to understand that the IRS will verify your financial information carefully.

Option 3: Currently Not Collectible (CNC) Status

If you are facing severe financial hardship and cannot afford to pay anything right now without missing basic living expenses, you may qualify for Currently Not Collectible (CNC) status. This is sometimes called being placed in “hardship” status.

When your account is marked CNC, the IRS temporarily stops active collection actions like levies and garnishments. Interest and penalties usually continue to accrue, and the underlying tax debt does not disappear. The IRS may also keep future refunds and apply them to your balance.

To qualify, you generally need to provide financial information similar to an OIC or non-streamlined Installment Agreement, often on Form 433-A or 433-F, showing that your allowable living expenses use up all your income. CNC is a good option if your situation is expected to improve later or if you are nearing the end of the collection statute and truly cannot pay.

Option 4: Penalty Abatement

IRS penalties can dramatically increase your total tax debt. In some cases, you can request Penalty Abatement, which is a reduction or removal of certain penalties.

The IRS may grant penalty relief for:

- Reasonable Cause such as serious illness, natural disaster, death in the family, or other circumstances beyond your control that prevented you from filing or paying on time.

- First-Time Penalty Abatement which is available to many taxpayers who have a history of compliance and are penalized for the first time for failure to file, failure to pay, or failure to deposit.

A common approach is:

- Make sure all required returns are filed and you are either paid up or in an Installment Agreement.

- Call the IRS or write a letter requesting penalty abatement, explaining your situation and citing either reasonable cause or first-time abatement rules.

- Provide supporting documentation when possible, such as hospital records or insurance claims for disasters.

While the IRS will not remove interest that accrued on unpaid tax, reducing or eliminating penalties can still meaningfully lower your total bill and help you pay off your tax debt faster.

Do You Need a Professional? A Decision-Making Framework

One of the hardest questions for taxpayers in trouble is whether to handle the IRS on their own or hire a tax relief professional. There is no one-size-fits-all answer. It depends on the size of your tax debt, the complexity of your situation, your comfort level with paperwork, and what collection actions you are facing.

Use the following checklists as a practical framework. Be honest about your situation and your stress level. Remember that even if you start DIY, you can bring in help later if things become more complicated.

A Checklist: When You Can Likely Handle It Yourself

You may be able to resolve your back taxes directly with the IRS if most of the points below apply to you:

- You owe less than $50,000 in combined tax, penalties, and interest.

- Your situation is relatively straightforward, for example you are a W-2 employee with no business entities, trust income, or complicated investments.

- All or most of your tax returns are filed, and any missing returns are easy to prepare.

- You are comfortable calling the IRS and dealing with notices, even if it is stressful.

- You likely qualify for a streamlined Installment Agreement and can pay the debt off within a few years.

- You do not currently have an IRS Revenue Officer assigned to your case.

In these situations, setting up a payment plan through the Online Payment Agreement tool, requesting penalty relief, or exploring an OIC using the official IRS resources may be a realistic do-it-yourself path.

A Checklist: When to Seriously Consider Hiring a Professional

There are times when bringing in a qualified Tax Attorney, Enrolled Agent, or CPA is wise and can actually save you money, time, and stress.

Strong signs you should consider professional help include:

- You owe a large amount, for example over $50,000, or your debt involves multiple years, audits, or payroll taxes.

- You own a business with unpaid payroll taxes (Form 941), potential trust fund recovery penalties, or complex bookkeeping issues.

- You have several unfiled tax years and are unsure how to get into compliance safely.

- You are already facing serious collection actions like an IRS Revenue Officer visit, bank levy, wage garnishment, or seizure threats.

- You believe you might qualify for an Offer in Compromise but feel overwhelmed by the financial forms and strategy.

- You are under criminal tax investigation or have received inquiries from the IRS Criminal Investigation division.

- You want a professional to handle all IRS communication on your behalf and shield you from direct contact.

If any of these apply, consider at least a consultation with a qualified professional so you understand your options before dealing with the IRS alone.

Navigating Professional Help: Credentials, Costs, and What to Expect

If you decide you need professional help, the next challenge is figuring out who to hire and what it should cost. The tax relief industry includes excellent professionals and also aggressive marketers and outright scams. Knowing how the industry works will help you make a smart choice.

Professional Credentials Explained: Tax Attorney vs. Enrolled Agent (EA) vs. CPA

Three main types of professionals commonly represent taxpayers before the IRS: Tax Attorneys, Enrolled Agents (EAs), and CPAs. All three can negotiate Installment Agreements, Offers in Compromise, and other resolutions with the IRS.

| Credential | Who They Are | Best Use Cases | Typical Cost Range (Approximate) |

|---|---|---|---|

| Tax Attorney | Licensed lawyer with training in tax law. Can represent you in Tax Court and handle criminal or complex legal issues. | Large or complex debts, audits with legal issues, potential criminal exposure, business and payroll tax cases. | $250 to $600+ per hour, or several thousand to tens of thousands for full representation. |

| Enrolled Agent (EA) | Licensed directly by the IRS after a comprehensive exam or IRS experience. Specializes in tax preparation and representation. | Most individual and small business tax debt cases, OICs, Installment Agreements, representation in audits and collections. | $150 to $350 per hour, or flat fees that often range from $1,000 to $7,500 depending on complexity. |

| CPA | Certified Public Accountant licensed by a state. Often focuses on accounting, tax preparation, and financial planning. | Cases involving financial statements, business bookkeeping, and tax planning along with resolution work. | $200 to $400+ per hour, or structured project fees in the low to mid four figures for many resolution cases. |

In practice, some professionals hold more than one credential, for example a CPA who is also an EA or an attorney with an accounting background. For many collection cases, an experienced EA or CPA can be just as effective as an attorney, but for potential criminal issues or tax litigation, a Tax Attorney is usually essential.

The True Cost of Tax Relief Services: A Transparent Fee Breakdown

One of the biggest information gaps in the tax relief industry is what services actually cost. While fees vary by region and complexity, realistic ranges can help you spot overpriced or underpriced offers.

Common fee structures include:

- Flat Fees: A set amount for a specific service, such as preparing and submitting an Offer in Compromise or setting up an Installment Agreement.

- Retainers and Hourly Billing: You pay a retainer upfront and the professional bills against it at an hourly rate for ongoing audits, Revenue Officer negotiations, or complex cases.

- Hybrid: A base flat fee plus hourly charges if the case becomes more complex than expected.

Approximate fee ranges many taxpayers see:

- Basic Installment Agreement or Penalty Abatement request: roughly $750 to $2,000.

- Offer in Compromise for an individual: roughly $2,500 to $8,000 depending on complexity and whether multiple years or businesses are involved.

- Representation in an active collection case with liens, levies, or a Revenue Officer: often $3,000 to $10,000, sometimes more for large or long-running cases.

- Serious business or payroll tax cases, or cases with potential criminal issues: $10,000 and up is common.

A critical red flag is percentage-based fees, where a company charges a percentage of the “tax savings” or the reduction they claim they will achieve. This model can incentivize unrealistic promises and is prohibited or discouraged by many professional ethics rules. Be wary of any firm that wants a large upfront payment plus a percentage of what they “save” you.

Legitimate firms typically:

- Provide a written engagement letter detailing services and fees.

- Explain which parts of the fee are nonrefundable, if any.

- Adjust fees if your case turns out much simpler or more complex than expected.

The Typical Engagement Process: From Consultation to Resolution

Most reputable tax relief professionals follow a similar process. Understanding it will help you know what to expect and avoid surprises.

Step 1: Free Initial Consultation & Discovery

You share a summary of your situation, including how much you owe, which years are involved, and what notices you have received. The professional asks questions to understand your goals, potential resolution options, and whether they are a good fit. They may quote a tentative fee range.

Step 2: Tax Investigation & Compliance

After you sign a power of attorney, they contact the IRS to pull your account transcripts and verify balances, missing returns, and current collection status. They also help you file any unfiled returns and ensure you are in compliance, which is a prerequisite for most relief programs.

Step 3: Strategy & Negotiation

Based on a detailed financial analysis, they decide whether an Installment Agreement, Offer in Compromise, Currently Not Collectible status, or another option best fits your situation. They prepare the necessary forms and supporting documentation, then negotiate with the IRS on your behalf.

Step 4: Resolution & Monitoring

Once an agreement is reached, they confirm the terms with you and the IRS. Some professionals continue to monitor your account, ensure payments are applied correctly, and help you avoid future problems by improving tax planning and compliance.

Warning: How to Spot and Avoid Tax Relief Scams

Because tax debt is stressful, some companies exploit fear and promise miracles. The Federal Trade Commission (FTC) has warned repeatedly about abusive tax relief outfits that charge high fees and do very little in return. Protecting yourself starts with knowing the red flags.

FTC Red Flags: Promises No Legitimate Company Can Make

According to official FTC warnings on tax relief companies, several patterns show up again and again in scams:

- “Pennies on the dollar” guarantees: No one can legitimately guarantee that the IRS will accept an Offer in Compromise for a particular amount. The IRS bases its decision on your actual financial situation, not a sales pitch.

- Promises to stop all collection activity immediately: A representative can often request a pause while they work on your case, but nobody can guarantee an instant halt to all IRS action, especially if a levy is already in process.

- High-pressure sales tactics: Pushy salespeople who insist you must sign and pay today or lose your chance at relief are a strong warning sign.

- Demands for large upfront fees without a clear description of services: Legitimate firms explain what you are paying for and how long it will likely take.

If a company’s claims sound too good to be true, they probably are. Always verify credentials and ask detailed questions before you sign anything.

Your Vetting Checklist: Questions to Ask Before You Sign Anything

Use this checklist whenever you speak with a tax relief company or professional:

- “Can I see your credentials?” Ask for their Enrolled Agent number, CPA license, or state bar information for attorneys. Verify these with the relevant authorities.

- “Who exactly will be working on my case?” Some large firms use salespeople to sign you up, then hand your case to less-experienced staff. Ask if you will have a dedicated EA, CPA, or Attorney.

- “Can I have a written contract detailing all fees and services?” Never rely on verbal promises. The engagement letter should spell out what is included and what will cost extra.

- “What is your experience with cases like mine?” Ask for examples of similar cases, especially if you have business, payroll tax, or large multi-year issues.

- “What is your success rate with Offers in Compromise?” No one can guarantee an OIC, but they should be honest about how often they file them and how many are accepted.

- “How will you communicate with me and how often?” Clear communication is crucial for a process that can take months or longer.

Where to Check Credentials and Reviews

After you collect information, verify everything independently:

- Use the IRS Directory of Federal Tax Return Preparers to confirm EAs, CPAs, and certain other credentials.

- For Tax Attorneys, check your state bar association website for license status and any disciplinary history.

- Search for the company on the Better Business Bureau (BBB) website and on reputable review platforms. Look for patterns of complaints, not just one bad review.

- Search the company’s name plus words like “complaint,” “lawsuit,” or “scam” to see if regulators or many consumers have raised concerns.

If anything seems off, walk away. There are many qualified, ethical professionals who can help without resorting to pressure or deception.

What About State-Level Tax Debt?

Federal tax debt is only part of the picture. Many taxpayers also owe money to their state’s Department of Revenue or similar agency. State tax collection can be just as aggressive as the IRS and sometimes even faster.

Key Differences Between IRS and State Tax Relief

Each state has its own rules, deadlines, and relief programs. Some offer their own versions of payment plans or Offers in Compromise, while others have more limited relief options.

- Different agencies: Instead of the IRS, you will deal with your state’s Department of Revenue, Franchise Tax Board, or similar agency.

- Different program names: A state “settlement program” may function like an OIC, but under different rules and formulas.

- Different collection timelines: States sometimes move to levy wages or bank accounts very quickly after a bill becomes overdue.

Because of these differences, you cannot assume that a solution which works for the IRS will automatically work at the state level. You often need to negotiate separately with each.

How to Find Help for Your State Tax Issues

A simple way to start is to search online for “[Your State] Department of Revenue” or the equivalent, such as Department of Taxation or Franchise Tax Board. On the official website you can usually find:

- Payment plan or Installment Agreement options.

- Possible state Offers in Compromise or settlement programs.

- Contact information for collections and taxpayer assistance units.

Many tax professionals who handle IRS matters also work with state tax agencies. If you already have an EA, CPA, or Tax Attorney for your federal case, ask whether they can represent you for state tax debt as well, or refer you to someone who can.

Real-World Scenarios: Tax Relief Case Studies

Abstract descriptions are useful, but real-world examples make it easier to see how tax relief services and IRS programs actually work. These anonymized case studies illustrate common patterns and outcomes. Your situation will be unique, but the principles are similar.

Case Study 1: Resolving a $75,000 Payroll Tax Debt

Problem: A small business owner with ten employees fell behind on quarterly payroll tax deposits (Form 941) during a downturn. Over several years, unpaid taxes, penalties, and interest grew to about $75,000. The IRS assigned a Revenue Officer and threatened to shut down the business and pursue the owner personally for the trust fund portion.

Process:

- The owner hired an Enrolled Agent experienced in payroll tax cases.

- The EA contacted the Revenue Officer, obtained transcripts, and confirmed all required returns were filed.

- The EA prepared a detailed financial statement for the business and the owner personally, showing that a lump-sum payment or full-pay Installment Agreement would likely force layoffs and closure.

- They proposed a partial pay Installment Agreement based on what the business could realistically afford each month while staying afloat.

- The EA also worked with the owner to improve cash flow management, so future payroll taxes were deposited on time.

Outcome: The IRS accepted a partial pay Installment Agreement. The business paid a manageable monthly amount, avoided seizure, and kept all employees. Penalties continued to exist, but the structured plan and improved compliance prevented further enforcement and gave the business a chance to recover.

Case Study 2: An Offer in Compromise for an Individual Taxpayer

Problem: A self-employed contractor owed about $42,000 from several unfiled years, including income tax and self-employment tax. Years of irregular work and poor recordkeeping led to underpayment and unfiled returns. The taxpayer was now earning modest income and supporting two children, with no significant assets.

Process:

- With professional guidance, the taxpayer filed all missing returns, which confirmed the $42,000 balance.

- They completed Form 433-A (OIC), carefully documenting income, necessary living expenses, and minimal assets.

- Based on the Reasonable Collection Potential calculation and the taxpayer’s low disposable income, the representative proposed an OIC of $6,500, payable in installments.

- They responded promptly to IRS requests for bank statements, proof of expenses, and explanations about past income fluctuations.

Outcome: After several months of review, the IRS accepted the Offer in Compromise for $6,500. The taxpayer completed the payments, stayed compliant for the required future period, and the remaining balance was forgiven. While results like this are not guaranteed, the case shows how an OIC can work when the numbers support it and the application is thorough and honest.

Frequently Asked Questions About Tax Relief Services

Q1: How much do tax relief services cost?

Costs vary widely based on your situation and who you hire. Simple cases, like setting up a straightforward Installment Agreement or requesting Penalty Abatement, might run from several hundred dollars to a couple of thousand. More complex work, such as an Offer in Compromise, handling a Revenue Officer case, or addressing large payroll tax debts, can range from a few thousand dollars to tens of thousands, especially if litigation or criminal issues arise. Always get a written fee agreement and avoid firms that only quote a price after intense sales pressure.

Q2: Can you really settle tax debt for less than you owe?

Yes, it is sometimes possible to settle for less through an Offer in Compromise, but only if you truly cannot afford to pay the full amount. The IRS compares your assets and future income to your tax debt using the Reasonable Collection Potential formula. If your offer is at least equal to what the IRS could reasonably collect before the statute of limitations expires, they may accept it. Many offers are rejected because the taxpayer’s financial information does not support the proposed settlement, so beware of anyone who guarantees “pennies on the dollar.”

Q3: How do I set up a payment plan with the IRS?

For many taxpayers, the easiest way is to apply online using the IRS’s Online Payment Agreement (OPA) tool. You will need to know how much you owe and propose a monthly payment that fits your budget. If you cannot use the online system, you can file Form 9465 by mail or call the IRS to discuss payment options. Make sure all required returns are filed before you request a plan, and be realistic about what you can afford long term to avoid defaulting on the agreement.

Q4: How do I know if a tax relief company is legitimate?

Legitimate companies employ licensed professionals like EAs, CPAs, or Tax Attorneys, clearly disclose their fees, and provide written engagement letters. They do not guarantee specific outcomes, especially for Offers in Compromise, and they do not rely on high-pressure sales tactics. Verify individual credentials through the IRS Directory of Federal Tax Return Preparers, your state bar, or state accountancy board, and check independent reviews and complaints before signing anything.

Q5: What is an Offer in Compromise (OIC)?

An Offer in Compromise is an agreement between you and the IRS to settle your tax debt for less than the full amount you owe. It is available to taxpayers who cannot pay their full liability and where collection of the full amount would create financial hardship or be unfair. To apply, you submit Form 656 and detailed financial information on forms like Form 433-A (OIC), and the IRS evaluates your ability to pay. Resources such as the IRS’s OIC Pre-Qualifier Tool can help you determine whether you might be a candidate before you spend time and money on a full application.

Q6: Will resolving my tax debt affect my credit score?

The IRS itself does not typically report tax debt directly to credit bureaus. However, a filed Notice of Federal Tax Lien can appear on your credit reports and hurt your credit score, and public records of liens may still be considered by some lenders even if they are not listed the same way they once were. When a lien is withdrawn or released, your credit should gradually improve, but it can take time. Because of this, regularly monitoring your credit score is a smart way to see whether a lien has been reported and to confirm that your credit picture improves after your tax debt is resolved.

Your Next Step to Becoming Tax Debt-Free

You have learned how the IRS collection system works, the core tax relief programs like Installment Agreements, Offers in Compromise, Currently Not Collectible status, and Penalty Abatement, and how to decide whether to handle things yourself or bring in a professional. You also now know how to spot tax relief scams and where to verify credentials and reviews before you hire anyone.

The most important step is the next one you take. Consider starting small: log in to your IRS account to view your balance, download your account transcript, or explore the IRS’s Online Payment Agreement (OPA) tool to see what kind of payment plan might work. If you are overwhelmed or facing serious enforcement, schedule a consultation with a qualified EA, CPA, or Tax Attorney and bring your notices so you can discuss real options, not just fears.

Resolving tax debt rarely happens overnight, but with a clear plan and the right help, it is absolutely achievable. Every letter you open, return you file, call you make, and payment plan you set up is a step away from anxiety and toward financial stability.